|

Positing Bitcoin mining stocks in a portfolio

|

|

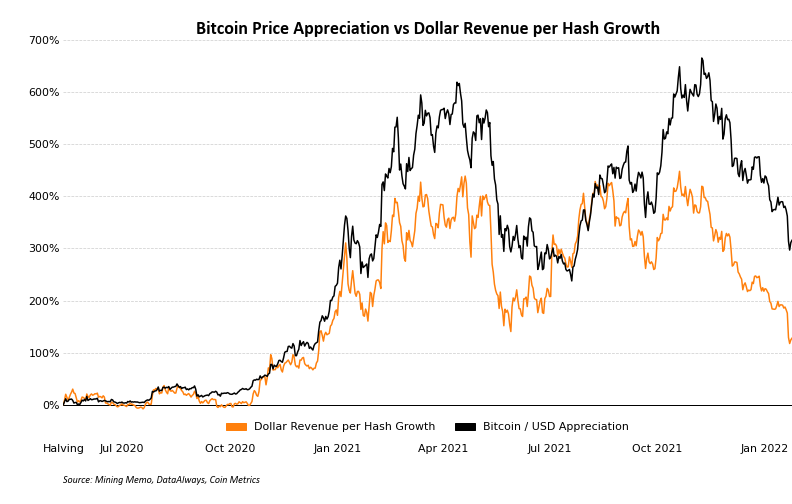

Bitcoin mining companies are an often-discussed revenue-centric alternative to investing directly in cryptocurrencies, but position sizing can be difficult to gauge as they remain highly correlated to bitcoin while bringing additional volatility to a portfolio. Check

out four portfolio constructions.

|

|

Click

here to continue reading this section of Mining Memo.

|

|

|

|

What to know about Bitmain's S19 Hyrdo

|

|

Althoug a seven nanometer (nm) chip, Bitmain’s newest Hydro miner clocks in at a 198 TH/s hashrate.

The increase in hashrate is dependent on the design's ability to overclock hashboards, wherein a computer runs at higher power to squeeze out more hashrate.

|

|

|

|

Bitcoin mining as a model of perfect competition

|

|

The bitcoin mining market is the first actualization of a perfectly competitive market. A theoretical microeconomic model, perfect competition consists of several attributes inheret to Bitcoin mining.

|

|

|

|

|

Leaving Proof-of-Work | Tim Beiko and Ben Edgington

|

|

The formal specification for Ethereum 2.0 is almost done and everyone is wondering when and how the Merge will happen. Ben Edgington & Tim Beiko, two developers working on implementing Eth 2.0, join us to talk about when and how a transition of such scale will

take place.

|

|

Click here to watch this

video podcast on YouTube.

|

|

|

|

|

About Compass: Compass is a Bitcoin mining and modern media company focused on driving the mass adoption of cryptocurrency mining.

|

|

|

|

Did a friend forward this email? Sign up here.

Want more Compass content?

|

|

|

|

|

|

|