|

|

|

Same newsletter, different value.

|

|

Welcome to the second weekly issue of Mining Memo! Unlike our insights focused weekend edition, this issue will solely focus on mining markets, including:

-

Bitcoin price

-

Hashprice

-

ASIC ROI

-

Public Mining Figures

The goal is to get you, the reader, top of the line insights and analytics into the mining markets in 10 minutes (or less). Feedback is welcome via email or Twitter (found at the bottom of the newsletter). Happy reading!

- The Compass Mining team

|

|

|

|

|

Bitcoin Price

|

|

|

Bitcoin has continued to trade sideways, or "crab," following November's record high of nearly $69,000. Investors are searching for fresh narratives after corporate treasury additions and nation-state adoption propelled Bitcoin upwards in 2020-21.

|

|

|

|

|

Hashprice (USD & Sats)

|

|

|

Hashprice is a measurement of mining output across different machine efficiencies. Here, we group all units together for one generalized price. Profitability in both Satoshis and USD remains flat at around $0.20 per terrahash (TH) as network difficulty and Bitcoin

price keep pace with each other.

|

|

|

|

|

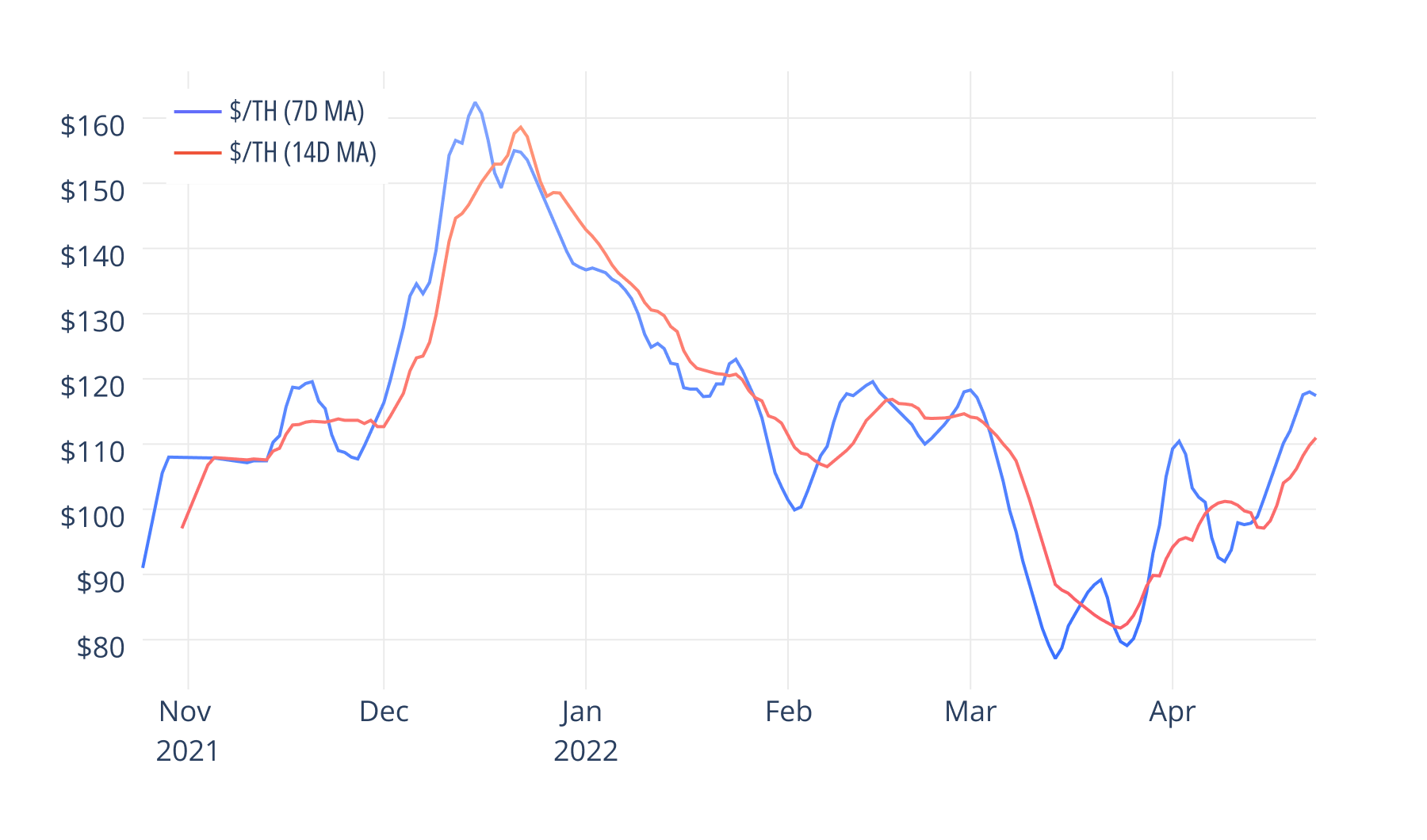

Average $/TH

|

|

|

Dollar per TH is a common metric used to price ASIC rigs over time. The $/TH generally trails Bitcoin's price by a few weeks. Here, we see ASIC prices correcting from December 2021 highs, one month after Bitcoin hit a new all time high in November.

|

|

|

|

|

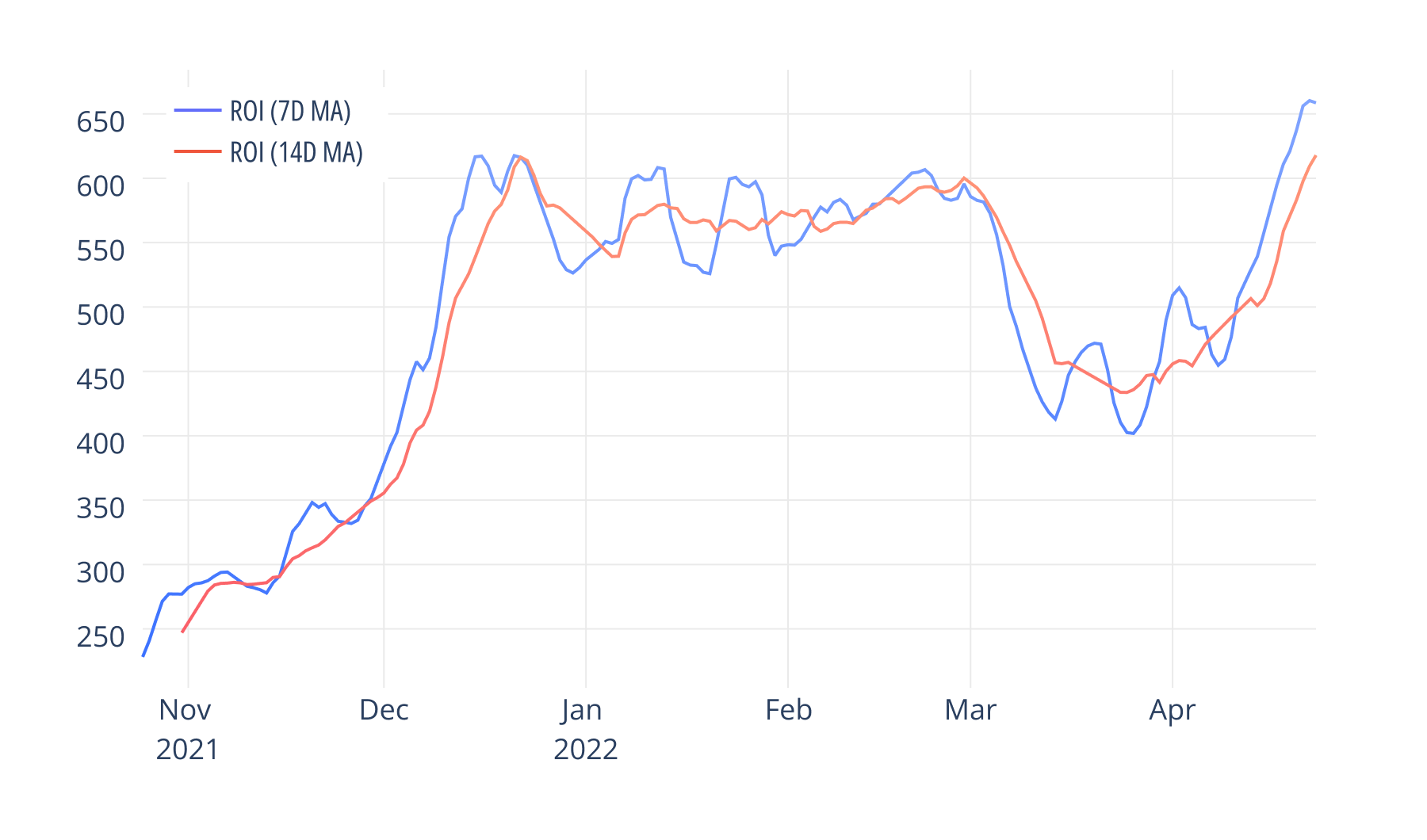

Machine ROI (Days)

|

|

|

Machine Return on investment (ROI) is a historically-derived measurement of how long it takes to pay off the upfront capital cost of a machine. A lagging indicator, Machine ROI has risen over the last few weeks as network difficulty has increased.

|

|

|

|

|

About Compass: Compass is a Bitcoin mining and modern media company focused on driving the mass adoption of cryptocurrency mining.

|

|

|

|

Did a friend forward this email? Sign up here.

Want more Compass content?

|

|

|

|

|

|

|