|

|

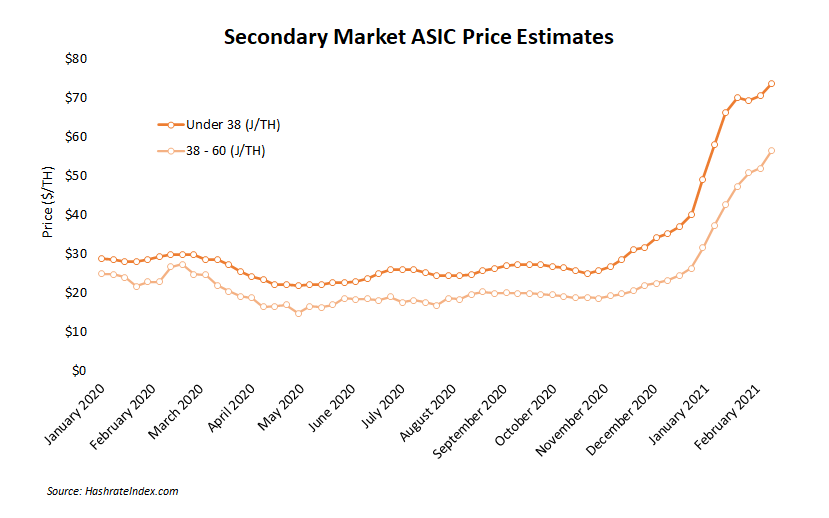

Secondary market ASIC prices are still climbing.

|

|

Keeping pace with bitcoin’s record price rally, ASIC prices on secondary markets are still climbing. Public mining companies, private miners, pools, and other companies across the industry are scrambling to secure more machines in a market hampered by

long-standing supplyline constraints. The demand-supply imbalance has pushed the prices for any available machines continuously higher.

In 2021, SHA-256 machines with less than 38 J/TH efficiency have increased over 50% to over $73, according to HashrateIndex. Estimates for second-hand rigs with 38-60 J/TH efficiency have spiked nearly 80% this year.

Over the same period, bitcoin has gained roughly 60%, extending its more than 300% rally through 2020.

|

|

|

Consistent with the heightened demand for machines across all ASIC markets, their incremental deployment has pushed mining difficulty up for the last four consecutive epochs. Difficulty now sits above 21.7 trillion.

This latest string of upward adjustments is certainly not the longest in bitcoin’s history. But it signals miners’ appetites to cash in on the bull run are as large as any other market participant.

When and how the mining sector’s ASIC shortage problems will be resolved is an open question. But demand for more machines isn’t dissipating, and until manufacturers are flush with new inventory, secondary markets will remain active and expensive.

|

|

|

Harsh weather hurts some Texas miners.

|

|

Like everyone else in the state, some bitcoin miners with farms in Texas have suffered the effects of the severe winter storm that brought large swaths of the state to its knees amid water shortages, power outages, and other crises.

Multiple mining farms in Texas have gone offline resulting from the severe weather and power outages. Companies like Bitmain and Layer1 Technologies operate farms in the state. Publicly traded Argo Blockchain plans to build a facility in the state. And Riot Blockchain is also in progress of completing a test of new

immersion-cooling technology for its mining farms.

Not all miners are suffering though. Some are helping fix the situation. Miners with unused energy are selling it back to the state’s grid, CoinDesk reported. With electricity prices reaching a whopping $9 per kWh, miners who sold electricity back to the grid

would have been lucratively compensated.

The state is in progress of recovering from the natural disaster, and aid from the federal government has been assured. But the Texas Tribune reported that the situation was so

severe that state officials said the entire region was “seconds and minutes” away from a monthslong blackout.

|

|

|

|

|

|

|

🧭 Hashrate Under Management (HUM): Compass and Hashr8 want to highllight an important metric that helps to clarify who owns what hash power. H.U.M. works to eliminate commonly double-counted hashrate with both mining facilities and mining

service companies claimining it. Read more about this metric in our blog post.

🧭 Kazakhstan Mining: Read the unique advantages and challenges Kazakh bitcoin miners face in the Hashr8 research team’s latest report. A

valid email address is required to download the report.

|

|

|

|

Other Highlights

|

-

Bitcoin drops after setting record highs above $58,000.

-

Pushing its year to date gains above 90%, bitcoin broke above $58,000 for the first time over the weekend. But the market quickly took back some of the gains as the leading cryptocurrency dropped to nearly $45,000 on Tuesday.

-

Ebang will start mining for itself.

-

Nvidia builds a product specifically for Ethereum miners.

-

Northern Data plans to go public in the US.

-

Northern Data is working with Credit Suisse on plans for a US public listing that could raise as much as $500 million, according to Bloomberg sources. The listing could go ahead later this year, per the report.

-

Mining difficulty increased (again!).

-

On Friday, Bitcoin’s mining difficulty rose 1.35%, to above 21.7 trillion. The latest adjustment marks the fourth consecutive (but third smallest) adjustment from the past four epochs. Currently, the next adjustment is predicted to tick downward slightly by

1.46%.

|

|

|

|

About HASHR8

|

|

We are a modern media and Bitcoin mining company focused on driving the mass adoption of cryptocurrency. Our research analysts and content creators strive to provide actionable and engaging content on the most relevant industry topics.

For more information, to submit a story for review, or to share a newsworthy tip, please email us at media@hashr8.com.

.

|

|

|

|

|

Written by Hashr8 Team

Was this email forwarded to you? Sign up here.

Want more Hashr8?

|

|

|

|

|

|

|